Tax Filing Services

Enhance Your Tax Efficiency with Professional Guidance.

The tax function is changing fundamentally because of factors like labor mobility, sustainability measures, digitization of taxes, and other uncertainties surrounding the global tax landscape. Tax executives need to be compliant while evolving into strategic consultants. We collaborate with you, applying a strict methodology to do tax jobs precisely, quickly, and on schedule.

We help you become more agile by connecting you with highly talented professionals with capabilities, technology, and creative ideas. We will support you in confidently leading your company through complexity as you adjust to your new role. JS Virtual Bookkeeping’s innovative approach is revolutionizing resource outsourcing for Tax filing Services. Our objective is to make it simple for tax firms to collaborate with international experts to satisfy their unique company tax and tax service requirements while maintaining reasonable prices. Our strategy is about providing flexibility, optimizing backend processes, and guaranteeing flawless compliance.

JS Virtual Bookkeeping’s proficient tax experts have years of experience at varying levels and in various states, making them well-suited to fulfill your company’s rigorous compliance requirements. We understand that every client has specific demands, and we design our services to address those needs. We adhere to the fundamental principles of professionalism, discretion, and accuracy, ensuring that your Tax Preparation Services needs are satisfied with the highest level of skill and attention. You may rely on us to provide outstanding tax services at an affordable price.

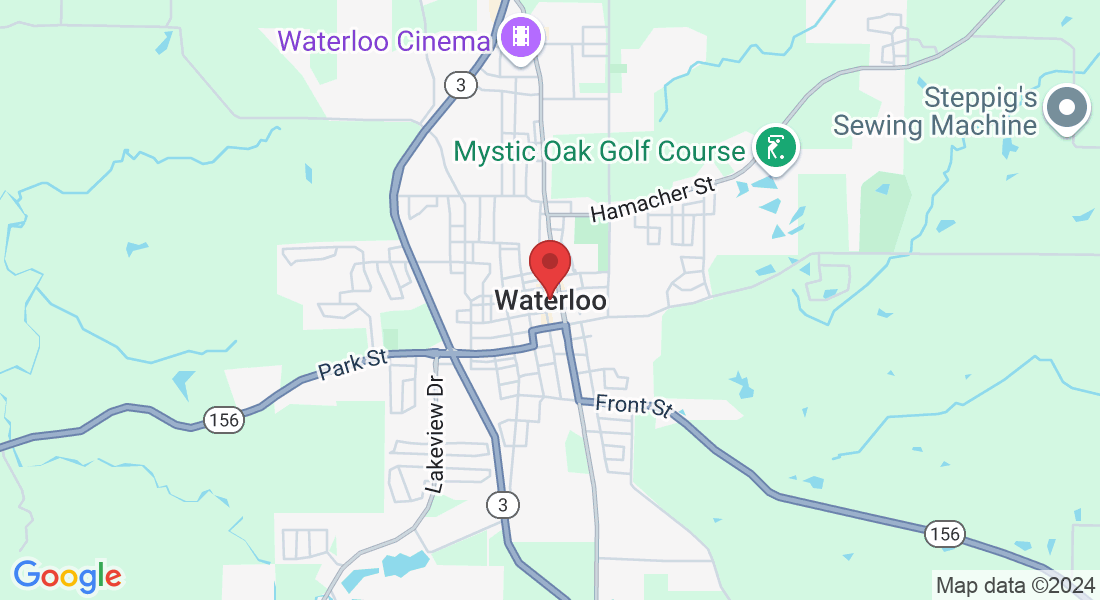

With years of experience in tax outsourcing, we work with clients from various industries to help them create stable global plans, optimize workflows, and boost tax activity efficiency. You may concentrate on expanding your business while our knowledgeable staff takes care of your clients’ financial accounting needs in an organized and legal manner. We provide customized solutions for IRS reporting and tax planning through our tax outsourcing services. By utilizing state-of-the-art tools and best practices that align with the latest industry standards, we have effectively offered Tax filing Services in Illinois to businesses, CPAs, and startups.

Taxation Capabilities

Our skilled group of tax professionals is committed to keeping your financial records in order and in compliance so you may confidently grow your company. Our tax services cover a broad range of options catered to your requirements, such as:

Tax Strategy and Planning: Utilizing professional tax counsel and preparation to minimize liabilities.

Prepare income tax returns: File income tax returns accurately and on time.

Effective administration of sales tax calculations and filings.

Quarterly Estimated Taxes: Paying quarterly taxes on time and estimating them accurately.

IRS Representation: Support for handling audits and IRS-related issues.

Tax Credits and Incentives: Determining which tax credits apply and using them.

Review of Tax Compliance: Extensive inspection to guarantee adherence to tax regulations.

Implementing Tax Software: Compiling and configuring tax software to ensure smooth functioning.

Tailored Reporting: Timely and precise filing of tax returns.

Effective tax administration is essential for any company, like JS Virtual Bookkeeping, to run smoothly and maintain correct financial records. A concise and organized tax workflow guarantees compliance, streamlines procedures, and offers information about the organization’s financial standing.

Frequently Asked Questions

What is the importance of professional bookkeeping for my business?

Professional bookkeeping is essential for several reasons. First and foremost, it ensures the accuracy and reliability of your financial records, which is crucial for making informed business decisions and maintaining compliance with tax regulations. Additionally, organized financial data simplifies the auditing process and can help you identify cost-saving opportunities and areas for business growth. Ultimately, professional bookkeeping saves you time, reduces the risk of financial errors, and allows you to focus on running your business effectively.

How often should I update my financial records?

The frequency of updating financial records can vary depending on your business's size and complexity. However, it's generally recommended to update your records on a regular basis, such as monthly or quarterly. Consistent record-keeping helps you stay on top of your financial situation, identify issues early, and make timely adjustments. With our services, we can establish a schedule that aligns with your business's specific needs and ensures your financial records are always up to date.

Is my financial data safe with your company?

Yes, the security of your financial data is one of our top priorities. We employ industry-standard security measures to protect your information from unauthorized access or data breaches. Our team is trained in data confidentiality and follows strict protocols to safeguard your records. Additionally, we use secure, encrypted channels for data transmission. You can trust that your sensitive financial information is in secure hands when you choose our bookkeeping services.

JS Virtual Bookkeeping Inc.

Gain control of your business's financial health with our comprehensive bookkeeping services. Whether you need cleanup, catch-up, daily, monthly, quarterly, or yearly services, we've got you covered. As certified Quickbooks Online ProAdvisor and Xero Advisor, we bring expertise and precision to your financial management, ensuring a clear, accurate, and reliable picture of your business's financials. Let us take the burden of bookkeeping off your shoulders so you can focus on growing your business.

Copyright ©2024 JS Virtual Bookkeeping Inc.

Facebook

Instagram

LinkedIn